If you have a 401, be sure to read up on the rules of required minimum distributions so you're not caught off-guard down the line. The last thing you want is to forgo some of your hard-earned savings because you failed to take your RMDs in time. That can make it harder to build a low-cost, diversified portfolio. Over 90% of employers that offer a 401 plan also kick in a company match, which means as you contribute, your employer will, too.

This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. Traditionally, most employers would offer employees vacation days, paid time off, or paid leave. Nowadays, employers tend to roll everything into one concept called paid time off . In some cases, unused PTO at the end of the year can be "exchanged" for their equivalent financial value. If a company does allow the conversion of unused PTO, accumulated hours and/or days can then be exchanged for a larger paycheck. Sometimes, it is possible to find avenues to lower the costs of certain expenses such as life, medical, dental, or long-term disability insurance.

How is a reverse mortgage repaid?

3) As part of our services, we will help you determine the exact amount (once you know the exact net self-employment income which is reported on line 31 of schedule C). We will also handle the required tax reporting (e.g. issuing 1099-r to report the rollover to a Roth IRA). Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you.

Moving money from a traditional 401 to a Roth account is a taxable event and can delay eligibility for penalty-free withdrawals, so be sure you know the rules before you do a rollover. Uncle Sam wants to collect its piece of the money eventually, though, so RMD rules exist to make sure those who have invested in a 401 begin taking the money out during retirement. The possibility that an investment will perform poorly or even cause you to lose money. In general, a low-risk investment will deliver lower potential returns and a high-risk investment may deliver higher returns, but may also cause you to lose your investment. Full Social Security benefits currently begin at age 66, but will rise to 67 for people born in 1960 and later. Early retirement benefits are available at 62, but at a lower monthly amount.

Bankrate

If you do not take your RMD, you'll face a 50% penalty on whatever amount you fail to withdraw. So if you're looking at a $5,000 RMD and you don't remove any money from your 401, you'll lose $2,500. Spreading investment dollars across a range of assets to cut down on your investment risk. When you invest in a new Merrill Edge® Self-Directed account. Check the background of Charles Schwab or one of its investment professionals usingFINRA's BrokerCheck. Use our online account transfer tool to initiate the process and monitor progress.

However, unlike the Roth IRA, contributions can't be withdrawn from a Roth 401 without penalty until five years after the plan starts, while a Roth IRA's contributions can be withdrawn at any time. This rule for the Roth 401 applies even after the age of 59 ½, when tax-free distributions are generally allowed. Also, unlike the Roth IRA, it has required minimum distributions at age 72, though at that stage, a Roth 401 could be rolled into a Roth IRA to avoid RMDs, without any tax penalty.

What are the requirements?

Inflation Calculator - calculate how much will your money worth in the future due to inflation. Future Value Calculator - calculate how much your money or assets will be worth in the future. Compare the value or most probable selling price to the outstanding balance of the loan. Only after we receive your application and signed counseling certificate can we begin the processing of your loan . Some states have further “cooling off” requirements that will not allow lenders to proceed for specified time periods after counseling has been completed with the third party.

This increases to 50% in the second year and 75% in the third year, with the employee becoming fully vested after 4 years. Some companies do not have schedules that increase vested amounts each year, but instead allow employees to become fully vested after a certain period of time. This is called cliff vesting, which means all of the vestings take place at a certain point in the vesting schedule. In this case, an employee that leaves a company before becoming fully vested will have to forfeit all employer contributions. Different 401 plans have different rules regarding vesting. For more accurate information, it is best to speak with human resources or 401 plan administrators.

Again, the percentage chosen is based on the paycheck amount and your W4 answers. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer subsidiary, Charles Schwab & Co., Inc. , offers investment services and products, including Schwab brokerage accounts. Its banking subsidiary, Charles Schwab Bank, SSB , provides deposit and lending services and products.

Also, a bi-weekly payment frequency generates two more paychecks a year (26 compared to 24 for semi-monthly). While a person on a bi-weekly payment schedule will receive two paychecks for ten months out of the year, they will receive three paychecks for the remaining two months. Next, we calculated the percentage of the population contributing to retirement accounts. We indexed the final values to 100, with a value of 100 reflecting the county where the most people who have access to employee retirement plans are contributing to those plans.

Program allows for older Americans to retain more liquidity and an increased cash flow by not having to pay all cash or take on another mortgage payment when purchasing a retirement home. Say you need some renovations done on your home and you know it will cost around $30,000 but are eligible for an $80,000 loan. That offers eligibility, real-time rates, and advice to help you select the right program. If you apply for the reverse mortgage, the appraised value will be established by an independent appraisal conducted by a licensed FHA approved appraiser. PaycheckCity delivers accurate paycheck calculations to tens of millions of individuals, small businesses, and payroll professionals every year since 1999. The gross pay method refers to whether the gross pay is an annual amount or a per period amount.

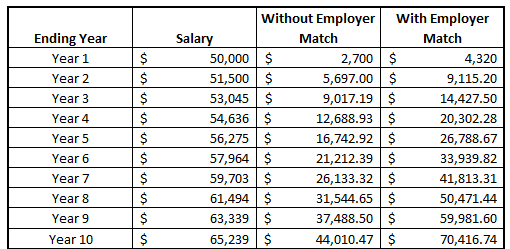

The amount of your RMD is based on your account balance and life expectancy. The government provides a tax break for retirement savings by allowing workers to contribute to a 401 with pre-tax funds and enjoy tax-free growth on investments within a 401. Commonly, that match will be worth 50% to 100% of your contributions, up to a limit that typically falls between 3% and 6% of your annual salary. If your employer offers up this free money, a good rule of thumb is to do everything you can to contribute enough to take advantage of it.

Other account fees, fund expenses, and brokerage commissions may apply. All investing is subject to risk, including the possible loss of the money you invest. Once you have those goalposts in mind, that’s what will determine the kind of account you should open. Think IRAs for retirement, 529s for college savings, and individual or joint accounts for general savings.

Chase Bank serves nearly half of U.S. households with a broad range of products. For questions or concerns, please contact Chase customer service or let us know at Chase complaints and feedback. Return on Investment Calculator - calculate the return on investment of an investment.

No comments:

Post a Comment