Table of Content

Chase Bank serves nearly half of U.S. households with a broad range of products. For questions or concerns, please contact Chase customer service or let us know at Chase complaints and feedback. Return on Investment Calculator - calculate the return on investment of an investment.

401s typically force you to begin taking distributions — called required minimum distributions, or RMDs — at age 72 or when you retire, whichever is later. You may be able to roll a Roth 401 into a Roth IRA to avoid RMDs. The annual 401 contribution limit is $20,500 for tax year 2022, with an extra $6,500 allowed as a catch-up contribution every year for participants age 50 or older. For 2023, you can contribute $22,500 and those ages 50 and up can contribute an extra $7,500. The average annual return you expect from your 401 investments each year. Pretax contributions are subject to the annual IRS dollar limit.

LLC Taxed as Sole Proprietorship QUESTION:

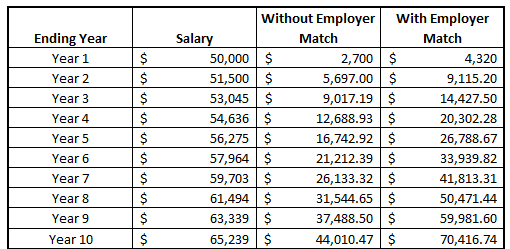

A survey has shown that 43% of employees would prefer to take a pay cut for a higher employer contribution to their 401s, rather than the other way around. Experts have likened the aspect of employer matching of 401s to "free money" or "pay raises" that should never be left on the table. Different employers use different methods of matching, such as a percentage of salary up to certain levels, or as a percentage of contributions up to a certain limit.

For instance, it is the form of income required on mortgage applications, is used to determine tax brackets, and is used when comparing salaries. This is because it is the raw income figure before other factors are applied, such as federal income tax, allowances, or health insurance deductions, all of which vary from person to person. However, in the context of personal finance, the more practical figure is after-tax income because it is the figure that is actually disbursed. For instance, a person who lives paycheck-to-paycheck can calculate how much they will have available to pay next month's rent and expenses by using their take-home-paycheck amount. A defined contribution plan is any retirement plan to which an employee or employer regularly contributes some amount. Often, the employee chooses to send a fixed percentage of monthly income to the account, and these contributions are automatically withdrawn, directly from her paycheck - no effort required.

Tax Brackets

These vary between mutual funds, index funds, or exchange-traded funds, all of which have an assorted mixture of stocks, bonds, international market equities, treasuries, and much more. The above options usually provide slow and steady growth of assets over time. Automated portfolios that adjust exposure to risk based on projected retirement age, such as target retirement funds, are also common. Participants who want to use their 401 retirement funds to actively invest in individual stocks can do so if their plan is set up a certain way. Employer matching–401s are known for often including an employer matching program.

For instance, someone who is healthy with no major diseases or injuries can reconsider whether the most expensive top-of-the-line health insurance is necessary. In addition, each spouse's company may have health insurance coverage for the entire family; it would be wise to compare the offerings of each health insurance plan and choose the preferred plan. The federal income tax is a progressive tax, meaning it increases in accordance with the taxable amount. The more someone makes, the more their income will be taxed as a percentage.

Self-Employed 401(k) Contributions Calculator

For example, let’s say you are 40 years old, and plan on retiring at the age of 67. That leaves 27 years for your current investments to gain value. It is also possible to roll over a 401k to an IRA or another employer's plan.

It's important to also steer clear of 401 plans that charge high fees if you want to keep more of your money working for you. At the same time, employees who participate in a 401 maintain control over their money. While employers provide a list of possible investment choices, most commonly different sorts of mutual funds, employees have quite a bit of freedom to decide their own strategy. Whether you are willing to take on a little more risk with your investments, or if you would rather play it safe, there’s probably an option for you. Even for employers who do not offer any matching program, every employer with a 401 plan is responsible for administering the plan. That may seem like it’s no big deal, but it actually saves quite a bit of trouble for the employees.

Bonus Tax Calculator Calculate withholding using your last paycheck amount on special wage payments such as bonuses. You are tax-exempt when you do not meet the requirements for paying tax. This usually happens because your income is lower than the tax threshold. For 2022, you need to make less than $12,950 for single filers, $25,900 for joint filers, or $19,400 for heads of household. For 2023 the standard deductions increased to $13,850 for single filers, $27,700 for joint filers, and $20,800 for heads of household. The IRA can give you more control over your account and allow you to access a larger investment selection.

Retirement Calculator - calculate how much you will have after retirement. 401k Calculator - calculate how much you have in 401K retirement. Credit Card Interest Calculator - calculate the total interest paid on a loan. Stock Profit Calculator - calculate your total profit or loss on a stock. Real Estate Commission Calculator - calculate the commission cost for selling your home.

Only after all of these factors are accounted for can a true, finalized take-home-paycheck be calculated. For instance, people often overestimate how much they are able to spend based on an inflated pre-tax income figure. Knowing the after-tax amount of a paycheck and using it to budget can help rectify this issue. For more comprehensive and detailed calculations regarding budgeting, try our Budget Calculator; just note that it also utilizes a before-tax input for income. Deductions can lower a person's tax liability by lowering the total taxable income.

Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal. In general, most 401 offerings allow an individual to invest in a variety of portfolios.

Waiting periods–Some employers don't allow participation in their 401s until after a waiting period is over, usually to reduce employee turnover. 6 month waiting periods are fairly common, while a one-year waiting period is the longest waiting period permitted by law. You'll start receiving the latest news, benefits, events, and programs related to AARP's mission to empower people to choose how they live as they age. If you are using Internet Explorer, you may need to select to 'Allow Blocked Content' to view this calculator. All home lending products are subject to credit and property approval.

The ability to withdraw contributions at any time, penalty and tax-free, as well as not having an RMD are two significant advantages of a Roth IRA that are missing in Roth 401s. A 401 match is an employer's percentage match of a participating employee's contribution to their 401 plan, usually up to a certain limit denoted as a percentage of the employee's salary. There can be no match without an employee contribution, and not all 401s offer employer matching. The 401 Calculator can estimate a 401 balance at retirement as well as distributions in retirement based on income, contribution percentage, age, salary increase, and investment return. In addition, catch-up contributions can be made if the business owner/participant attains age 50 before the close of the solo 401k plan year. The catch-up contribution limit is $6,500 for 2021 (IRC Sec. 414).

Get advice that's personalized just for you.

Chase isn’t responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name. Interest Only Loan Calculator - calculate interest only loan payments. Mortgage Payoff Calculator - calculate how long it will take to pay off your mortgage balance. Salary Calculator - salary converter to convert from hourly rate to annual income. Counselors are required to ask potential borrowers about income, assets, debts, and monthly living expenses to perform a budget analysis.

This increases to 50% in the second year and 75% in the third year, with the employee becoming fully vested after 4 years. Some companies do not have schedules that increase vested amounts each year, but instead allow employees to become fully vested after a certain period of time. This is called cliff vesting, which means all of the vestings take place at a certain point in the vesting schedule. In this case, an employee that leaves a company before becoming fully vested will have to forfeit all employer contributions. Different 401 plans have different rules regarding vesting. For more accurate information, it is best to speak with human resources or 401 plan administrators.